From Chaos to Clarity: Organizing Your Finances with Budgeting Tools

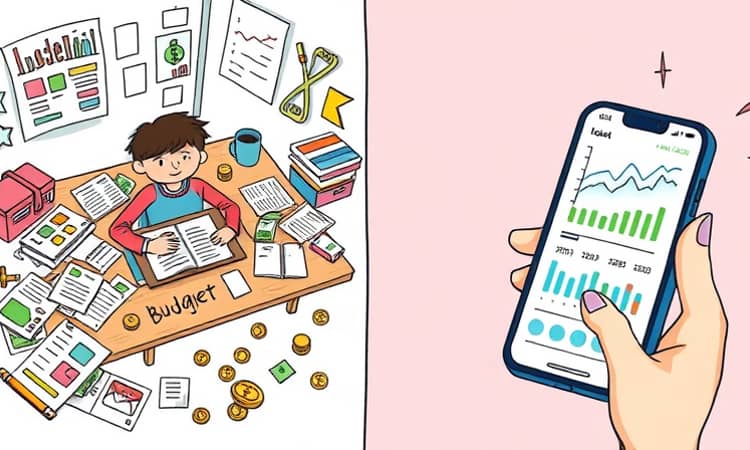

In today's fast-paced world, managing finances can often feel like navigating a storm of uncertainty and disorganization.

Bills pile up, savings seem out of reach, and unexpected expenses create a sense of helplessness.

However, there is a beacon of hope: modern budgeting tools and applications that can revolutionize your financial life.

These digital solutions offer a path from chaos to clarity, transforming overwhelming data into actionable insights.

By embracing technology, you can achieve financial stability and peace of mind.

This article will guide you through leveraging these resources to build a secure and organized future.

The Current State of Financial Management

Despite high confidence levels, a significant gap exists between informal budgeting and structured planning.

For instance, 88.7% of people feel at least some confidence in managing finances, yet only 41% have a written budget.

This disconnect highlights the need for more effective strategies to bridge intention and action.

- 83.1% report following a budget, whether strictly or loosely.

- 72% of households do not have a written financial plan.

- Only 19% are comprehensive planners with a methodical approach.

Such statistics reveal that while many aim to manage money, few do so systematically.

Financial chaos often stems from this lack of documentation and clear goals.

The Digital Revolution in Personal Finance

The personal finance apps market is experiencing explosive growth, driven by technological advancements.

Valued at USD 31.7 billion in 2025, it is projected to reach USD 173.6 billion by 2035.

This expansion reflects a shift towards integrated financial ecosystems that simplify money management.

- 45.3% of people use digital solutions for managing money.

- 20.9% specifically rely on budgeting apps for daily tracking.

- An additional 24.4% utilize online calculators or spreadsheets.

With 91% of Americans owning smartphones, access to these tools is nearly universal.

This digital transformation empowers users to take control with real-time data and automation.

This table illustrates the diverse approaches people take, highlighting the growing role of digital tools.

Key Features of Effective Budgeting Tools

To truly transform finances, budgeting tools must offer comprehensive and intuitive features.

These elements help users move from chaos to clarity by addressing core challenges.

- Real-time financial insights for immediate awareness of spending patterns.

- User-friendly interfaces that simplify complex data into digestible visuals.

- Automatic savings features to build reserves without manual effort.

- Goal-setting tools that keep you motivated and on track towards objectives.

- Integration with everyday banking for seamless management across accounts.

Additionally, AI-based features like predictive cashflow analysis enhance decision-making.

Such tools go beyond basic tracking to offer solutions for overcoming money problems.

Overcoming Common Financial Challenges

Many individuals struggle with issues like overspending or fluctuating income.

Budgeting apps can mitigate these challenges by providing proactive alerts and insights.

- Track expenses daily to curb impulse purchases and identify wasteful spending.

- Set up notifications for bill payments and savings goals to avoid missed deadlines.

- Use automated features to forecast financial trends and adjust plans accordingly.

This approach turns obstacles into opportunities for growth and financial resilience.

By addressing users' biggest challenges, tools foster sustainable habits.

Building Sustainable Financial Habits

Consistency is key to long-term financial health and achieving clarity from chaos.

Tools that encourage regular engagement and mindfulness lead to better outcomes.

- Review your budget weekly to stay aligned with goals and make necessary adjustments.

- Celebrate milestones, no matter how small, to maintain motivation and positivity.

- Adjust your financial plan as life circumstances change for adaptability and relevance.

Households with a financial plan are 2.5 times more likely to save sufficiently for retirement.

This statistic underscores the importance of structured planning for future security.

The Future of Financial Organization

With advancements in AI and open banking, the future of budgeting tools looks promising.

These innovations are evolving into integrated financial ecosystems that offer personalized services.

Open banking formulation through standardized APIs fuels data-driven and tailored solutions.

As the market grows, tools will become more adept at preventing financial chaos.

Embracing these technologies can pave the way for financial freedom and lasting clarity.

Start your journey today by exploring available tools and taking the first step towards organized finances.

References

- https://www.academybank.com/article/banking-trends-in-2025-and-beyond-budgeting-apps-for-financial-success

- https://www.financialeducatorscouncil.org/personal-finance-statistics/

- https://www.researchnester.com/reports/personal-finance-apps-market/8243

- https://consumerfed.org/press_release/new-research-shows-most-american-households-do-financial-planning-but-the-extent-of-this-planning-varies-greatly/

- https://www.pewresearch.org/short-reads/2024/12/09/roughly-half-of-americans-are-knowledgeable-about-personal-finances/

- https://savology.com/13-financial-statistics-you-need-to-know

- https://www.cubesoftware.com/blog/forecasting-and-budgeting-software

- https://www.bluevine.com/blog/financial-literacy-statistics

- https://www.georgetown.edu/news/this-money-habit-can-revolutionize-your-finances/

- https://www.financealliance.io/financial-charts-and-graphs/